California Has Some of the Highest Taxes in the Nation and I Disagree With the Push for More

- Morris Patrick III

- Jan 1

- 5 min read

California consistently ranks among the highest taxed states in the United States, yet state and local governments continue to pursue additional revenue streams. From rising sales tax rates to new fees imposed through healthcare systems and emergency services, Californians are being asked to pay more at nearly every point of daily life. I strongly disagree with this approach and believe it reflects a deeper policy failure rather than a genuine revenue necessity.

Recent developments such as San José’s approval of a first responder medical fee and statewide sales tax rate changes illustrate a troubling pattern. Instead of reforming how funds are managed and allocated, policymakers increasingly rely on indirect taxes and fees that ultimately fall on working families and consumers.

Sales Taxes in California Are Already Excessively High

California already has the highest statewide base sales tax rate in the nation. According to the California Department of Tax and Fee Administration, the base rate is 7.25 percent, and many local jurisdictions impose additional district taxes that raise the total rate above 10 percent in numerous communities. New district tax rate changes took effect in April 2025, further increasing costs for consumers across the state (California Department of Tax and Fee Administration, 2025).

Sales taxes are inherently regressive because they apply uniformly regardless of income level. Lower and middle income households spend a greater share of their earnings on taxable goods, meaning sales taxes consume a disproportionate percentage of their income. Expanding reliance on sales taxes shifts the tax burden away from wealth and onto everyday consumption, undermining fairness in California’s tax system.

Emergency Response Fees Are the Wrong Funding Tool

In late 2024, San José leaders approved a $427 first responder fee for certain medical 911 calls. City officials stated that the fee would be billed to health insurers rather than residents directly, framing the policy as a method to recover emergency response costs without increasing traditional taxes (CBS News, 2024).

This distinction is misleading. Health insurers do not absorb these costs. They incorporate them into premium calculations, deductibles, and out of pocket expenses. As a result, residents still pay indirectly through higher healthcare costs. This approach places a financial consequence on medical emergencies and raises serious concerns about equity and access to emergency services.

Emergency medical response is a core public function. Funding it through per call fees contradicts the principle that individuals should not hesitate to seek emergency assistance due to financial uncertainty.

Why Is California Still Chasing More Revenue

State and local officials often justify new taxes and fees by citing funding needs related to healthcare, infrastructure, homelessness, and public safety. California is not a low revenue state. It has one of the largest economies in the world and already collects significant tax revenue at both the state and local levels.

The issue is not a lack of money but a lack of long term fiscal prioritization and accountability. Rather than addressing administrative inefficiencies or reassessing spending structures, policymakers frequently turn to consumption taxes and service fees that are politically easier to enact. These measures generate short term revenue while increasing long term financial pressure on residents.

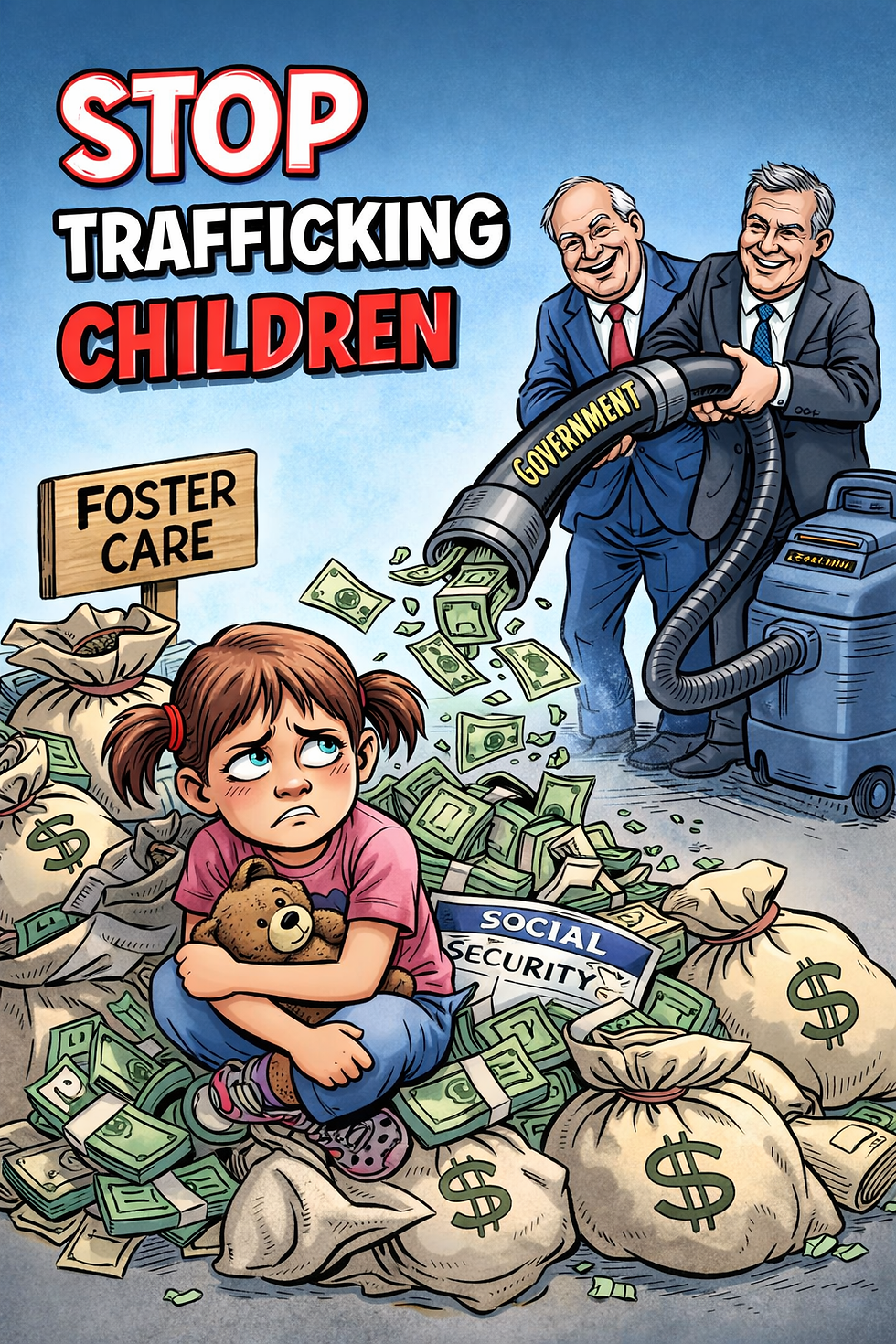

At the same time California argues that it needs more revenue, investigative reporting has repeatedly shown that funds intended for vulnerable children are not always used for their benefit. In California and across the country, child welfare agencies have been documented taking Social Security survivor and disability benefits that legally belong to foster youth and using those funds to offset agency costs rather than placing the money in trust for the children (CalMatters, 2023; National Public Radio, 2021). National investigations have found that foster care agencies collectively take millions of dollars each year that are owed to children in their custody, often without meaningful notice or consent (Investigative Reporters & Editors, n.d.).

These practices raise serious policy questions about why the state continues to pursue new taxes and fees from the public while failing to safeguard money already allocated to children under its care.

ASFA Incentives and the Financialization of Child Removal

Critics of the child welfare system have long argued that the Adoption and Safe Families Act of 1997 created a financial incentive structure that prioritizes foster care placements and adoptions over family preservation. Under ASFA, states receive federal reimbursement tied to foster care maintenance payments and adoption incentives, while preventive and reunification services are often underfunded or time limited.

Investigative reporting has shown that when children enter foster care, agencies gain access to multiple funding streams, including Title IV-E reimbursements and, in some cases, the children’s own Social Security benefits (CalMatters, 2023; National Public Radio, 2021). This has led advocates to warn that the system risks becoming a revenue driven pipeline where child removal generates income for agencies, contractors, and service providers, while families lose both their children and critical financial resources.

When viewed alongside rising taxes and new municipal fees, this dynamic creates a disturbing contradiction. California claims it needs more money for public services, yet documented evidence shows that funds intended for foster youth are routinely diverted to sustain the system itself. To many families and advocates, this resembles a state sanctioned child trafficking economy driven not by the best interests of children but by financial incentives embedded in federal and state policy.

Health Insurers Are a Pass Through Not a Solution

Billing health insurers for emergency response services is often framed as a way to protect taxpayers. In practice, it expands healthcare costs statewide. Insurance premiums are calculated based on total expenditures, and mandated emergency response fees increase those expenditures.

This system ensures that even individuals who never use emergency services will experience higher insurance costs. It also shifts public safety funding into the healthcare market, reducing transparency and accountability in public budgeting while increasing financial strain on insured residents.

A Different Policy Direction Is Possible

California does need sustainable funding for essential services, but sustainability does not come from repeatedly increasing taxes and fees on the same residents. A fairer approach would emphasize progressive revenue structures, fiscal discipline, and rigorous oversight of existing programs.

Before asking Californians to pay more through sales taxes, insurance premiums, and emergency fees, the state should demonstrate that it can protect children’s benefits, prevent misuse of foster care funds, and eliminate perverse incentives that reward family separation. Public trust cannot be rebuilt through higher taxes alone. It requires accountability, transparency, and a commitment to ensuring that money meant for children and families is actually used for them.

Until policymakers confront these systemic failures, new taxes and fees will continue to feel less like shared responsibility and more like an unfair burden imposed to sustain broken systems.

References

CalMatters. 2023. Social Security foster benefits. https://calmatters.org/california-divide/2023/04/social-security-foster-benefits/

California Department of Tax and Fee Administration. 2025. California sales and use tax rates effective April 2025. https://cdtfa.ca.gov/taxes-and-fees/April2025ratechange.htm

CBS News. 2024. San Jose leaders approve $427 first responder fee for medical calls. https://www.cbsnews.com/sanfrancisco/news/san-jose-leaders-approve-427-first-responder-fee-medical-calls/

Investigative Reporters & Editors. n.d. Foster care agencies take millions of dollars owed to kids. https://awards.journalists.org/entries/foster-care-agencies-take-millions-of-dollars-owed-to-kids/

National Public Radio. 2021. State foster care agencies take millions of dollars owed to children in their care. https://www.npr.org/2021/04/22/988806806/state-foster-care-agencies-take-millions-of-dollars-owed-to-children-in-their-ca

Comments